Search

-

Prevent Osteoporosis: Take Control of Your Bone Health Today

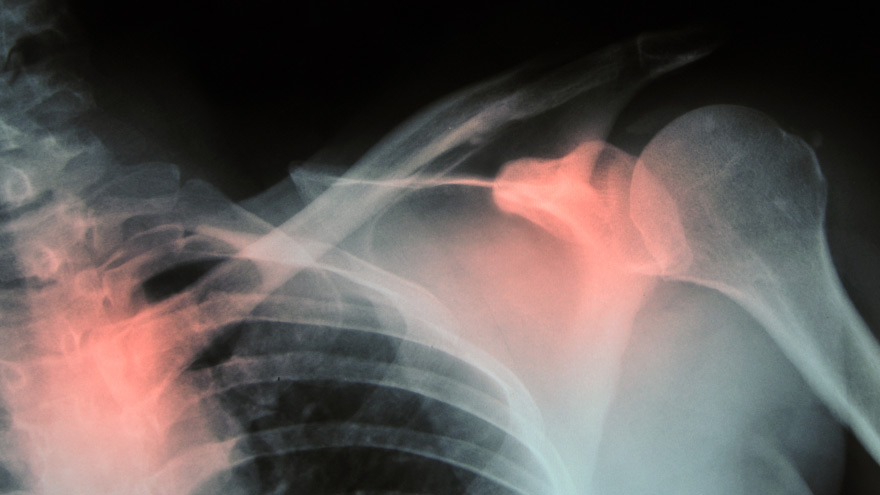

Some risk factors associated with osteoporosis are out of your control. But you’re in luck, because some can be lessened by following simple tips. Below, Orthopedic Nursing Manager Katie McCarthy discusses the signs, symptoms and preventive measures. By Katie McCarthy, BSN, RN, ONC, Orthopedic Nursing Manager, Renown Health Osteoporosis is often called the silent disease, because it develops gradually for years with no clear signs or symptoms. And while some bone loss is expected as we age, osteoporosis is not a normal part of aging. So it’s important to start thinking about your bone health early. Bone is not just a lifeless scaffold for the body. It is living tissue that regenerates continually. Once we reach peak bone mass around age 25, we begin losing more bone than we produce, increasing the risk of developing osteoporosis — which literally means porous bone and points to a loss in bone density. In severe cases, normal everyday activities or movements, like hugging, can cause a fracture. After the first fracture you’re at higher risk for more, which can lead to a life of chronic pain and immobility. Bone fractures in the spine or hip are the most serious. Hip fractures can result in disability and even death — especially in older adults. Spinal fractures can even occur without falling. The vertebrae weaken to the point that they simply crumple, which can result in back pain, lost height and a hunched-forward posture. Osteoporosis: Uncontrollable Risk Factors Women are at greater risk of developing osteoporosis than men, and white and Asian women are at higher risk than black and Hispanic women. Other uncontrollable risk factors include: age; a family history of osteoporosis; certain genetic conditions; medications and medical treatments; eating disorders; a low body weight and small, thin frame; ethnicity; menopause: In fact, the lack of estrogen produced during menopause is largely responsible for a woman’s increased risk. Poor diet, tobacco use, excessive alcohol consumption, lack of exercise and an unhealthy weight also contribute to bone loss. Fortunately, those risk factors are in your control. Without symptoms, you can’t know if you’ve developed osteoporosis unless you get a bone density test or suffer a fracture. If you fall into a high-risk group, are over age 50 or have any concerns about your bone health, consult your doctor and find out if you need to be evaluated. Additionally, if either of your parents sustained hip fractures, you experienced early menopause or took corticosteroids for several months — a steroid often prescribed to relieve inflammation and arthritis — you’ll want to talk to your doctor about your bone health. If you test positive, your doctor will devise a treatment plan to match your needs, which will include lifestyle changes surrounding diet and exercise to build and strengthen weak bones. Medication to slow bone breakdown and build new bone may be prescribed, depending on the severity of your bone loss. If you’ve sustained a spinal fracture that is causing severe pain, deformity or is not responding to non-surgical treatment, your doctor may recommend surgery. Reduce Your Risk of Osteoporosis You can strengthen your bones now to prevent osteoporosis from starting. Here are some tips: Eat a diet rich in fruits and vegetables and low in caffeine, sodium and protein. Avoid soda, and talk to your doctor to make sure you’re getting enough calcium and vitamin D. Don’t smoke — it directly correlates with a decrease in bone mass. Smokers also take longer to heal from a fracture. Limit alcohol to two to three beverages per day. It interferes with the production of vitamins needed to absorb calcium and the hormones that help protect bones. Exercise three to four times each week — it’s key to healthy bones. Weight-bearing exercises like jogging, hiking and especially weight lifting build bone mass and density. There are aspects of the aging process we can’t control, but we can do something about bone loss and osteoporosis. Find out your risk, and show your bones a little TLC — you’re going to need them. This story was also published in the Reno Gazette-Journal’s Health Source on April 24, 2016.

Read More About Prevent Osteoporosis: Take Control of Your Bone Health Today

-

A True Joint Effort: Exercises to Prevent Knee Pain

Experiencing knee pain during exercise or while undertaking daily activities? The knee is the largest joint in our body, so it goes without saying a lot hinges on its functionality. Here are a few exercises to help. Is exercise a real pain in the knee for you? Does getting up in the morning require a few minutes for your knees to adjust to walking around? As it turns out, knee pain is common, and it can result from injury, overuse or the breakdown of cartilage over time. Often, this pain is a result of faulty mechanics in your body, according to Jessica Ryder, a physical therapist with Renown Physical Therapy and Rehab. “We see weakness at the hips causing a lot of stresses at the knee,” she says. Exercises that Alleviate Knee Pain Try these three exercise to strengthen your glute muscles and maintain proper alignment in your knees. Hip Lift Lie flat on your back with your knees bent and feet flat against the floor. Lift your hips into the air until your body is in a neutral position, then lower your hips back down. Repeat this motion several times until you feel a gentle burn in your glute muscles. Step Down Stand with one foot on a stair or step. Slowly bend your knee and drop the other foot toward the floor. Slowly extend back up to your starting position. While doing this exercise, it’s important to move slowly, maintain control and ensure that your knee is in line with your toes. Do as many reps as needed until you feel a small fatigue in your muscles. Repeat this exercise on the opposite leg. Side Step with Exercise Band Place an exercise band around your ankles. Stand in a slight squat and then take several steps to the side until you feel a small fatigue on the outside of your hips. While doing this exercise, keep your upper body still and focus the exercise to your hips. The band will try to move your knees toward each other Repeat in both directions. Hometown Health and Renown Health are proud to be the official insurance plan and healthcare partners of the Nevada Wolf Pack. Renown Physical Therapy and Rehab | 775-982-5001 Through outpatient physical, occupational and also speech therapy, Renown Physical Therapy and Rehab gives patients hands-on, individualized treatment. Our therapists use evidence-based methods to help patients return to an active, productive lifestyle. Learn More About PT

Read More About A True Joint Effort: Exercises to Prevent Knee Pain

-

Copays vs. Coinsurance: Know the Difference

Health insurance is complicated, but you don't have to figure it out alone. Understanding terms and definitions is important when comparing health insurance plans. When you know more about health insurance, it can be much easier to make the right choice for you and your family. A common question when it comes to health insurance is, "Who pays for what?" Health insurance plans are very diverse and depending on your plan, you can have different types of cost-sharing: the cost of a medical visit or procedure an insured person shares with their insurance company. Two common examples of cost-sharing are copayments and coinsurance. You've likely heard both terms, but what are they and how are they different? Copayments Copayments (or copays) are typically a fixed dollar amount the insured person pays for their visit or procedure. They are a standard part of many health insurance plans and are usually collected for services like doctor visits or prescription drugs. For example: You go to the doctor because you are feeling sick. Your insurance policy states that you have a $20 copay for doctor office visits. You pay your $20 copay at the time of service and see the doctor. Coinsurance This is typically a percentage of the total cost of a visit or procedure. Like copays, coinsurance is a standard form of cost-sharing found in many insurance plans. For example: After a fall, you require crutches while you heal. Your coinsurance for durable medical equipment, like crutches, is 20% of the total cost. The crutches cost $50, so your insurance company will pay $40, or 80%, of the total cost. You will be billed $10 for your 20% coinsurance.

-

Health Insurance Terms Explained: Deductible and Out-of-Pocket Maximum

Health insurance might be one of the most complicated purchases you will make throughout your life, so it is important to understand the terms and definitions insurance companies use. Keep these in mind as you are comparing health insurance plan options to choose the right plan for you and make the most of your health insurance benefits. One area of health insurance that can cause confusion is the difference between a plan's deductible and out-of-pocket maximum. They both represent points at which the insurance company starts paying for covered services, but what are they and how do they work? What is a deductible? A deductible is the dollar amount you pay to healthcare providers for covered services each year before insurance pays for services, other than preventive care. After you pay your deductible, you usually pay only a copayment (copay) or coinsurance for covered services. Your insurance company pays the rest. Generally, plans with lower monthly premiums have higher deductibles. Plans with higher monthly premiums usually have lower deductibles. What is the out-of-pocket maximum? An out-of-pocket maximum is the most you or your family will pay for covered services in a calendar year. It combines deductibles and cost-sharing costs (coinsurance and copays). The out-of-pocket maximum does not include costs you paid for insurance premiums, costs for not-covered services or services received out-of-network. Here's an example: You get into an accident and go to the emergency room. Your insurance policy has a $1,000 deductible and an out-of-pocket maximum of $4,500. You pay the $1,000 deductible to the hospital before your insurance company will pay for any of the covered services you need. If you received services at the hospital that exceed $1,000, the insurance company will pay the covered charges because you have met your deductible for the year. The $1,000 you paid goes toward your out-of-pocket maximum, leaving you with $3,500 left to pay on copays and coinsurance for the rest of the calendar year. If you need services at the emergency room or any other covered services in the future, you will still have to pay the copay or coinsurance amount included in your policy, which goes toward your out-of-pocket maximum. If you reach your out-of-pocket maximum, you will no longer pay copays or coinsurance and your insurance will pay for all of the covered services you require for the rest of the calendar year.

Read More About Health Insurance Terms Explained: Deductible and Out-of-Pocket Maximum

-

Understanding "In-Network" and "Out-of-Network" Providers

When finding a provider to receive your health services, you've probably heard the terms "in-network" and "out-of-network" when it comes to your health plan. But what do these terms mean for a patient? And why should you be aware if a provider is out-of-network? What does it mean when a provider is "in-network" with a health plan? A provider is a person or facility that provides healthcare. When a provider is in-network it means there is a contractual agreement with that health plan regarding the rates for services. The provider will accept negotiated rates for services from the insurance. This means a patient will typically pay less for medical services received and is less likely to receive surprise bills. What does it mean when a provider is "out-of-network" with a health plan? Providers that are out-of-network are those that do not participate in that health plan's network. The provider is not contracted with the health insurance plan to accepted negotiated rates. This mean that patients will typically pay more or the full amount for the service they receive. Why should patients see in-network providers? Seeing an in-network provider for medical services can significantly reduce your medical expenses. Remember that in-network providers have a contractual agreement for negotiated rates with the health plan, so they cannot charge you more than that negotiated rate for a service. Seeing an in-network provider will always ensure any costs you do incur (copays or co-insurance) are applied to your health plan's deductible and out-of-pocket maximum (out-of-network costs don't apply to these amounts). To find the amounts you will pay for specific services, you can check your health insurance plan's Summary of Benefits. What is the best way to find which providers are in-network with a patient's health plan? Most health insurance companies offer multiple ways to find if a provider is in-network. To find the most accurate benefit information from your health plan, you can: Call their Customer Service department Check their website for their online provider directories If offered, check your online member portal.

Read More About Understanding "In-Network" and "Out-of-Network" Providers

-

3 Ways to Switch to a Medicaid Plan Accepted at Renown

Medicaid plays a significant role in our health care system and is the nation’s public health insurance program. In addition, this program is the predominant source of long-term care coverage for Americans. Renown Health is contracted with two Medicaid plans: Molina and Anthem. If you currently have a different plan but want to change to one that Renown accepts, you can request to change plans during the open enrollment period from January 1 to March 31. Request to change your Medicaid plan in one of three ways: Request a change to your plan, or managed care organization (MCO), by reviewing the available MCO plans online at bit.ly/MCOPlansNV and filling out the form on the webpage. Email Nevada Medicaid to ask for a plan change and include your name, Medicaid ID and the names and Medicaid IDs of any dependents in your home: MCORedistribution@dhcfp.nv.gov. Call your local Medicaid district office at 775-687-1900 (northern Nevada) or 702-668-4200 (southern Nevada) to ask about changing your plan. For more information about the Medicaid plans accepted at Renown Health, please visit: Anthem Molina Healthcare Renown Health accepts most insurances, but please visit the link below for the full list. Click here for all accepted plans

Read More About 3 Ways to Switch to a Medicaid Plan Accepted at Renown

-

Bone Fractures in Children Honest Expert Advice

Michael Elliott, MD, head of the Department of Pediatric Orthopedics and Scoliosis, answers some common questions about bone fractures. Is there a difference between broken bones and fractures? No, these are two different names for the same injury. Of course the common term is a broken bone. Using either name will describe your concerns. Medical personnel typically describe a broken bone as a fracture to a specific bone. For example, a broken wrist is also a fractured distal radius. To clarify, this describes the injured bone and the precise location. How do I know if my child has broken their bone? Many times children will fall and complain of their arm or leg hurting. In most cases the pain goes away and the child will return to their activities. When there is a deformity to the limb (curve in arm) and the child is complaining of pain, it is probably a fracture. If the arm or leg looks straight, look to see if there is any swelling or bruising. Both are signs of a possible fracture. Finally, if the limb looks normal but the child continues to complain, gently push on the bone. Likewise if it causes the same pain, then they likely have a fracture and should have an x-ray. My child fractured their growth plate, what does this mean? Growth comes from this area of the bone. In detail, these are located all over the body but typically at the end of the bones. With this in mind, fractures to these areas can result in the bone growing abnormally. Because of potential shortening of the arm or leg, or bones growing crooked, it is important to follow fractures closely (up to 1-2 years or longer). It is better to identify a problem early. Small problems can be treated with small surgeries. What if the bones of the x-ray do not line up? Because children are growing, unlike adults, their bones will remodel and straighten with growth. The amount of remodeling occurring depends on a child’s age, the bone fractured and the location. In many cases an angled bone will grow straight over the course of a year. For this reason, someone with experience in caring for children needs to follow bone growth. How long does it take fractures to heal? Factors deciding when a cast can come off include: Child’s age. Bone fractured. Fracture location. Young children heal faster than teens, teens heal faster than young adults, who heal faster than older adults. In young children most fractures heal in 4-6 weeks. However, teens generally take 6 weeks to heal, and adults can take much longer. Although your child is out of their cast, it may not be healed completely to return to all activities. Placing a splint is during this time is common. This typically gives them added protection for several weeks after their cast is removed - in case they forget their limitations. What if my child is still limping? Whether a child is in a walking or non-weight bearing cast, removing it often leaves them stiff and sore. Therefore many children will walk as though they still have a cast in place. In most cases this resolves in about three weeks. Regardless, if your child is still limping or walking abnormally after three weeks, contact the treating doctor. They may benefit from physical therapy or a repeat evaluation. (This article was original published in the July 2019 issue of South Reno Kids & Sports.)

Read More About Bone Fractures in Children Honest Expert Advice

-

Health Insurance Terms Explained: HMO, EPO and PPO Plans

When it comes to purchasing a health insurance plan, you’ve probably heard of the two plan types, HMO and PPO, but what exactly do these terms mean, and what is an EPO? Let’s learn more about these plan types and how you can choose the plan that meets your needs. What is an HMO Plan? HMO stands for “Health Maintenance Organization.” HMO plans contract with doctors and hospitals creating a network to provide health services for members in a specific area at lower rates, while also meeting quality standards. HMO plans require you to select a primary care physician (PCP) and usually require a referral from your PCP to see a specialist or to have certain tests done. If you choose to see a provider outside of the HMO’s network, the plan will not cover those services and you will be responsible for all charges. What is an EPO Plan? An EPO means “Exclusive Provider Organization.” This plan provides members with the opportunity to choose in-network providers within a broader network and to visit specialists without a referral from their primary care doctor. EPO plans offer a larger network than an HMO plan and typically do not have the out-of-network benefits of PPO plans. Generally, EPO plans cost more than an HMO, but less than a PPO. What is a PPO Plan? PPO stands for “Preferred Provider Organization.” PPO plans are often more flexible when it comes to choosing a doctor or a hospital. These plans still include a network of providers, but there are fewer restrictions on the providers you choose. PPO plans do not require you to select a primary care physician (PCP), giving you a broader network of providers. So, which plan should you choose? Each plan type has different benefits, so it depends on your health needs when choosing the right plan type. If you are looking for flexibility when choosing providers and locations, a PPO plan may better fit your needs. An EPO plan may be a better option if you travel often and want the flexibility of a larger network, but don’t necessarily need out-of-network benefits. If you regularly seek care in a certain geographic area and are looking for a health insurance plan at a lower price point, consider an HMO plan. To keep costs low, insurance carriers contract with providers and partner in plan members’ health to ensure quality care at the lowest cost. Whether you choose an HMO, EPO or PPO option, partnering with your health insurance carrier and your healthcare provider will help you receive the best care while controlling your out-of-pocket costs. Get the most out of your health insurance benefits! Established in 1988, Hometown Health is the insurance division of Renown Health and is northern Nevada’s largest and only locally-owned, not-for-profit insurance company providing wide-ranging medical coverage and great customer service to members.

Read More About Health Insurance Terms Explained: HMO, EPO and PPO Plans

-

What is Care Coordination for Senior Care Plus Members?

Cost-saving isn’t the only reason to enroll in a Medicare Advantage Plan. One of the main reasons Medicare beneficiaries in Nevada join a Senior Care Plus Medicare Advantage Plan is for the care coordination services. The Senior Care Plus Care Coordination team helps members navigate what can be a complex healthcare system. Care coordination is a popular and extremely important service for members because keeping members healthy is the number one goal. One way they help reach this goal is to encourage members to participate in a no-cost, comprehensive health assessment. At this Quick Start Health Assessment, members meet with a geriatric specialist – a provider who specializes in the care of seniors – to discuss the 4 Ms: Mentation – Thinking, memory and mental health Medications – Understanding your medication Mobility – Staying physically active What Matters to You – Let your provider know what is important to you – examples could be family, health and independence The results of this detailed visit are then shared with the member’s primary care provider, so a customized care plan can be developed. This is a free service for Senior Care Plus members, along with an annual wellness visit and an annual physical exam. Care Team Approach – Laying the Foundation to Improve Health Health assessments and annual visits are offered so Renown Health providers can build relationships to improve care. This approach, also known as the Building Relationships to Improve Care or BRIC Model, is the care model used across Renown Health. “What’s special about this care model is that it really puts our patients at the center of their care,” says Savannah Gonsalves, a registered nurse with Senior Care Plus. “Members have their providers and nurses, Senior Care Plus personal assistants, case managers, and within the BRIC Model, they’re all talking to one another and putting the focus on the patient to meet needs.” Personal Assistants – A Unique Connection to Each Member A team of personal assistants is available to help members coordinate care by: Scheduling a member’s appointments Answering a member’s benefits questions Helping navigate care – these are experts in both health insurance and healthcare Answering questions about medications Working with providers to coordinate a member’s care The Senior Care Plus personal assistants are one of the most popular services that the Medicare Advantage plan offers. Each personal assistant has a direct phone line so members can call them to ask questions. “After my hip surgery my personal assistant, Megan checked in on me every day,” recalls Janelle, a Senior Care Plus member. “She made sure that I was doing alright and that I didn’t need anything. She just let me know that she was there for me.” To Learn More Senior Care Plus is the largest Medicare Advantage Plan in northern Nevada. They offer $0 plans with low co-pays with access to Renown Health and Teladoc Virtual Visits that cover you nationwide. To learn more about Medicare Advantage plans and to see if you qualify, visit SeniorCarePlus.com or call 775-982-3158 to speak to an enrollment specialist.

Read More About What is Care Coordination for Senior Care Plus Members?